How do I place a VAT or Tax exempt order?

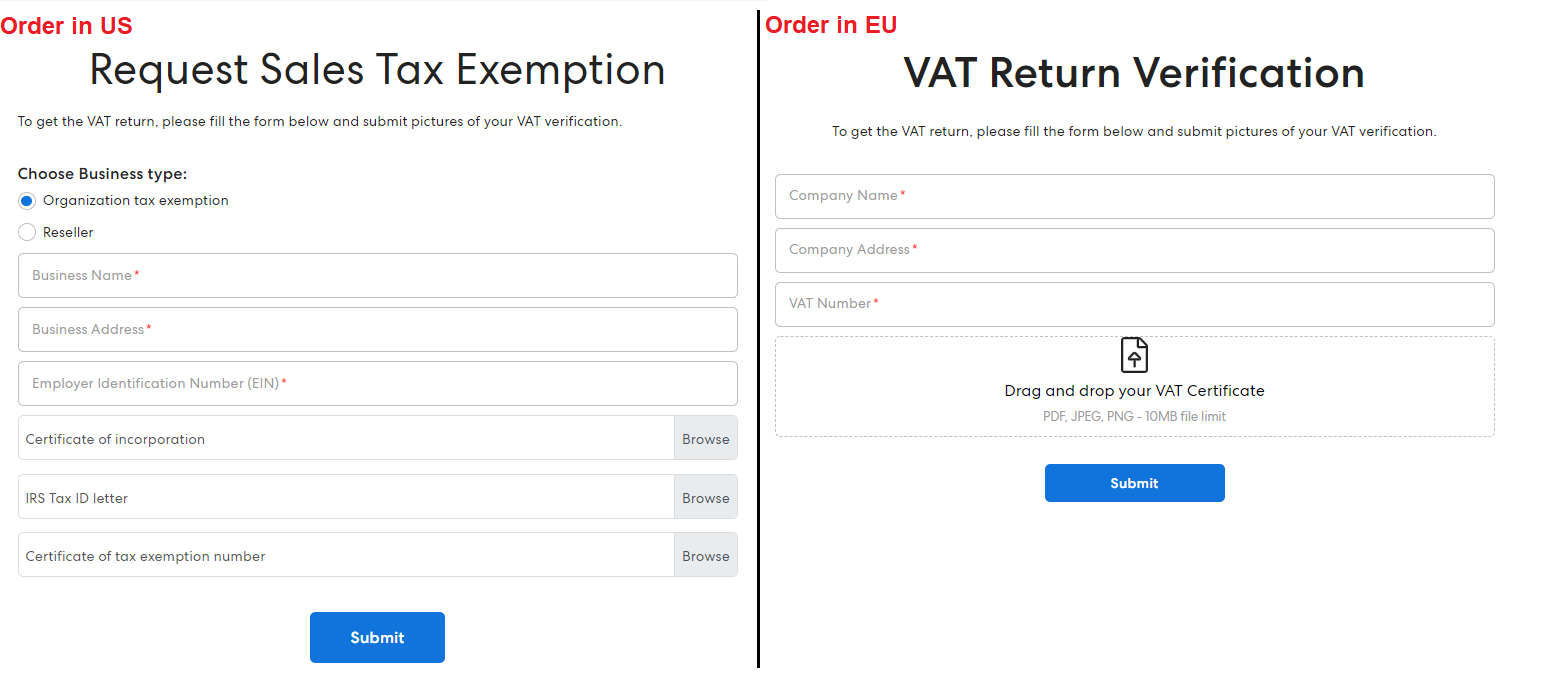

Autonomous supports tax exemption claims for all orders in EU countries (business only) or orders that have a tax exemption certificate in the US. All the customers are required to pay tax or VAT in advance. Please note that Orders from a business account are free of tax or VAT and we only accept one tax-exempt account for one EIN (Employer Identification Number)/ VAT number.

Complete the Tax-Exempt or VAT Application by following the prompted questions and uploading documents.

- Before proceeding, it is necessary to place the order with VAT or tax.

- Monitor the order until it is shipped or delivered

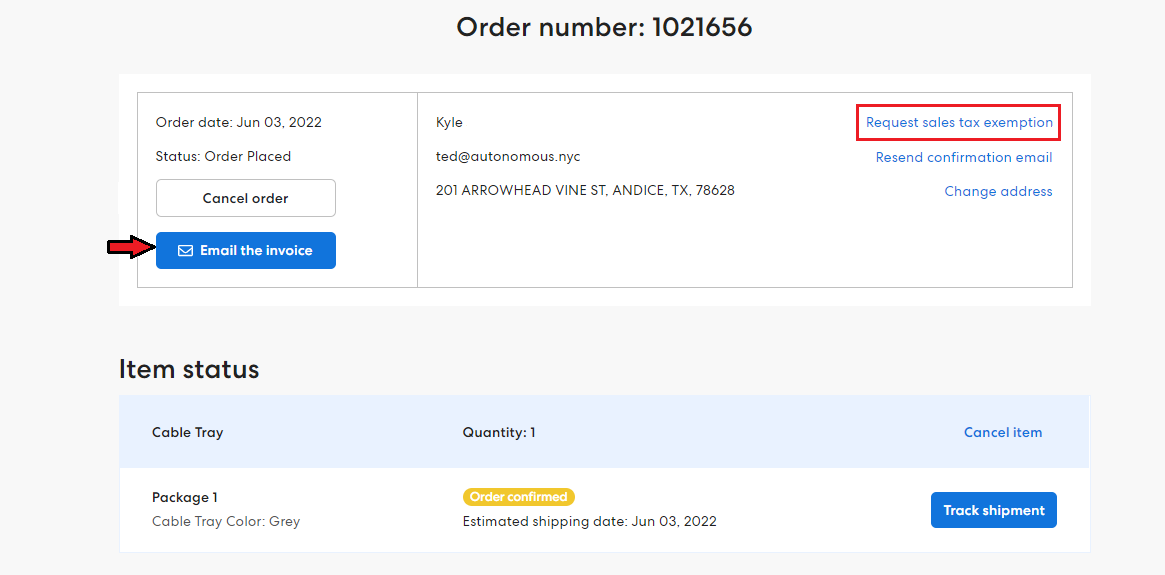

- Open Track Your Order page, or "Your orders" on the Autonomous home page following this article.

- Click on the "Request sales tax exemption" button.

4. You must provide valid tax-exempt or VAT document(s) for each state where exempt goods are shipped and hit "Submit".

5. Once your application has been submitted, your documents will be reviewed and a determination made whether your application for exemption is approved. Please note it may take up to 5 business days for your status to be approved or denied. If approved, you will get a tax or VAT refund to your original method and be eligible to make tax-exempt for the next purchases immediately

* Personal purchases and other non-qualified purchases must not be made under this account and that any misuse may result in the suspension of the Autonomous account as well as government penalties.

.svg)