ADU Loan Rates in San Diego: A Homeowner's Guide

Table of Contents

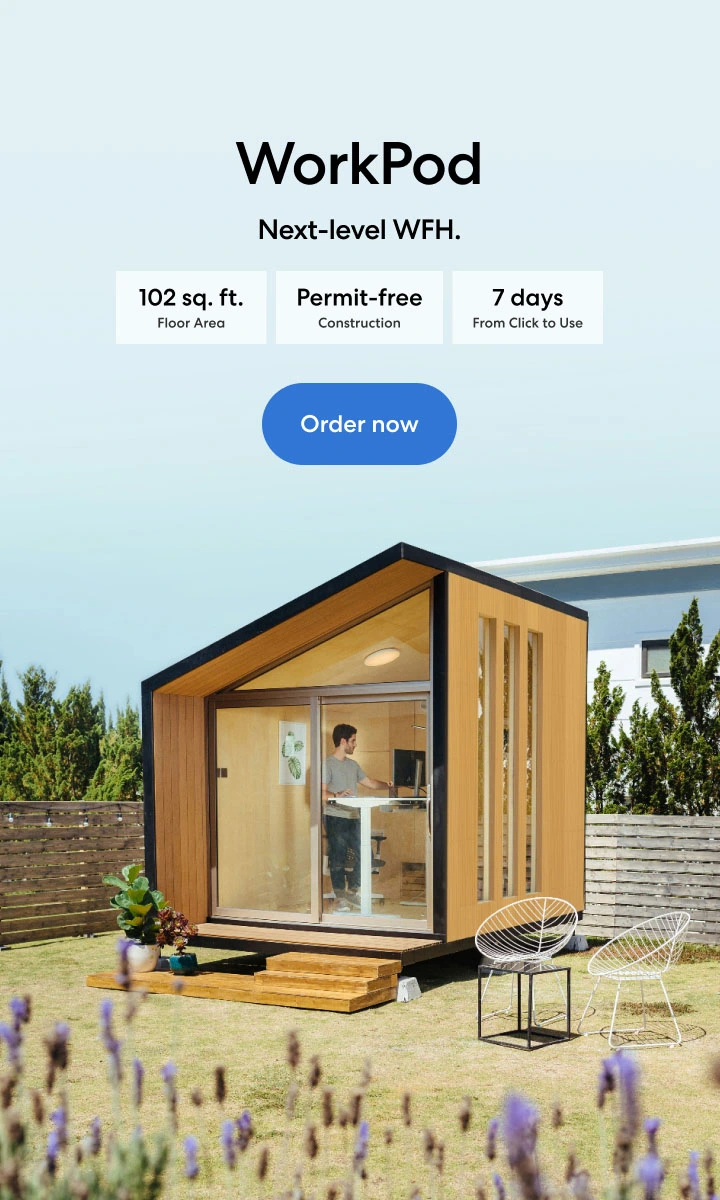

When considering an ADU (Accessory Dwelling Unit), understanding ADU meaning is crucial. Prefab ADUs offer a streamlined construction process, making them an appealing option for many homeowners. To find the best prefab ADU in California, focus on models that balance quality and cost-effectiveness. Financing options such as ADU construction loan rates are essential to explore. ADU loans in San Diego tailored to the local market can ease the financial burden. Researching these aspects ensures you make informed decisions, creating a seamless experience in adding an ADU to your property.

San Diego, with its vibrant culture and sunny skies, is facing a housing crunch. Accessory Dwelling Units (ADUs), often called granny flats or backyard cottages, are emerging as a popular solution. But how do you finance this exciting addition to your property? This guide will break down ADU loan rates in San Diego, helping you navigate the financial landscape and make informed decisions.

Why ADUs?

ADUs offer numerous benefits:

- Increased Property Value: A well-designed ADU can significantly boost your home's value.

- Rental Income: Generate extra income by renting out your ADU.

- Affordable Housing: Provide housing options for family members or tenants.

- Multigenerational Living: Create comfortable living spaces for extended family.

Financing Your ADU: The Basics

Before diving into specific loan rates, it's important to understand your financing options:

- Construction Loans: These cover the costs of building your ADU. Once construction is complete, you might refinance into a permanent loan.

- Home Equity Loans or Lines of Credit (HELOCs): Borrow against your home's equity to finance the ADU.

- Personal Loans: Generally smaller loan amounts, but a good option for smaller ADU projects.

- Cash-Out Refinance: Refinance your existing mortgage for a larger amount, using the extra cash to build your ADU.

- Government-Backed Loans: Programs like FHA Title 1 loans or Fannie Mae's HomeStyle Renovation loan can be used for ADUs.

ADU Loan Rates in San Diego

Interest rates for ADU loans vary depending on the loan type, your credit score, the loan amount, and the lender. Here's a general overview:

- Construction Loans: Interest rates can range from 5% to 9%, often with higher rates during the construction phase.

- Home Equity Loans or HELOCs: Rates can be as low as 4%, but they are variable and can fluctuate.

- Personal Loans: Interest rates vary depending on your creditworthiness, but can be higher than other loan types.

- Cash-Out Refinance: Rates will be similar to current mortgage rates.

- Government-Backed Loans: These loans often come with lower interest rates and more flexible requirements.

Key Considerations for San Diego Homeowners

- City Regulations: San Diego has specific ADU regulations, so familiarize yourself with these before starting your project.

- Loan Costs: Factor in closing costs, appraisal fees, and any prepayment penalties.

- Permits and Approvals: Building an ADU requires permits and approvals, which can impact your timeline and budget.

- Construction Timeline: Delays in construction can affect your financing, so plan carefully.

Where to Find ADU Loans in San Diego

Many lenders in San Diego offer ADU loans. Consider local credit unions, community banks, and national lenders. Don't hesitate to shop around and compare rates to find the best deal for your situation. San Diego's mild climate and relaxed lifestyle make it a perfect place for ADUs. By adding an ADU to your property, you not only increase your home's value but also contribute to the city's housing solutions.

Your ADU Dream Starts Now!

Building an ADU is an exciting venture. With careful planning and the right financing, you can create a beautiful, functional living space that enhances your property and your lifestyle. Don't let the financial aspect intimidate you. With this guide and a little research, you'll be well on your way to securing the perfect ADU loan in San Diego.

FAQs

1. What is an ADU loan program?

ADU loan programs are specialized financing options designed to support the construction or renovation of ADUs. These programs may offer competitive rates and flexible terms to make ADU projects more accessible.

2. Are there special loan programs for building a prefab ADU in Southern California?

Yes, some lenders offer specific financing options for prefab ADU in California. These loans may streamline the process due to the shorter construction timeline and potentially lower costs associated with prefab construction.

3. How do ADU construction loan rates in San Diego compare to regular construction loans?

ADU construction loan rates are generally similar to those for standard construction loans. However, some lenders may offer specialized ADU loan programs with competitive rates. It's crucial to compare rates and terms from different lenders.

4. Where can I find an ADU loan calculator to estimate my monthly payments in San Diego?

Many online ADU loan calculators are available. Look for calculators specifically tailored to San Diego to get the most accurate estimate based on local rates and regulations. Some lenders also offer calculators on their websites.

5. Are there any government-backed ADU loan programs in San Diego?

Yes, San Diego homeowners can explore government-backed loan options like FHA Title 1 loans or Fannie Mae's HomeStyle Renovation loan, which may offer lower interest rates and more flexible requirements compared to conventional loans.

6. How do I choose the best ADU loan program for my needs in San Diego?

The best ADU loan program depends on your financial situation, project goals, and preferences. Consider factors like interest rates, loan terms, down payment requirements, and lender reputation. Comparing multiple lenders and loan options is crucial to find the best fit for you.

Conclusion

The budgetary process of constructing an accessory dwelling unit (ADU) in San Diego need not be daunting. To get the money you need to build your ADU, learn about your loan options, compare rates, and consider local regulations. A detached garage unit (ADU) is a good investment for many reasons, including increased property value, added living space for family members, and rental income. Your dream of owning a lovely, practical ADU in beautiful San Diego is within reach if you have access to the correct information and resources.

Stay connected with us!

Subscribe to our weekly updates to stay in the loop about our latest innovations and community news!

Interested in a Link Placement?

Spread the word

.svg)

.svg)

/https://storage.googleapis.com/s3-autonomous-upgrade-3/production/ecm/230914/bulk-order-sep-2023-720x1200-CTA-min.jpg)

/https://storage.googleapis.com/s3-autonomous-upgrade-3/production/ecm/230824/image_tMoN47-V_1692155358869_raw-93ed49d8-7424-464e-bdfe-20ab3586d993.jpg)